FAQ

Login / Logout

1. How can user do when it is unable to login into SPtrader?

Several reasons lead to the login problem:

‧ The wrong host is typed. Please check with your broker to see if the host is typed correctly.

‧ Cannot access the internet. Please contact your ISP(Internet services provider) to check the stability of your network.

‧ Firewall is set. Please open the ports 8080 to 8089 if firewall setting is allowed. Otherwise please tick the 80 port while login if it is permitted on broker side. For further details please contact your broker.

‧ Proxy is used for browsing the internet. Please tick the "Proxy" while login and click the button to input the proxy information, and try login again. Since proxy settings may limit the websites to be access, please also inform technicians on your side to allow SPSystem to login through port 80 and 443.

‧ The wrong host is typed. Please check with your broker to see if the host is typed correctly.

‧ Cannot access the internet. Please contact your ISP(Internet services provider) to check the stability of your network.

‧ Firewall is set. Please open the ports 8080 to 8089 if firewall setting is allowed. Otherwise please tick the 80 port while login if it is permitted on broker side. For further details please contact your broker.

‧ Proxy is used for browsing the internet. Please tick the "Proxy" while login and click the button to input the proxy information, and try login again. Since proxy settings may limit the websites to be access, please also inform technicians on your side to allow SPSystem to login through port 80 and 443.

2. Can the same user ID be login at different places?

SP System allows user to login at different places, but each time it is limited to single login only. "User Already Login" will be displayed if user tries double login.

3. Can SPsystem automatically logout for me when forget to logout?

Yes. Please set the "Inactive Timeout" interval in "PreferenceàGeneral Preference". SPsystem will automatically logout if no action is performed within the time interval

Transaction

1. Why can't users place order even they have made successful login into SPTrader?

‧ Users have not changed their password upon first login. To protect our users a first time password change is needed before they can proceed to trading.

‧ Password has expired. Our system also requires client to change their passwords regularly to ensure security. If password has expired, users just need to change to a new password before trading.

‧ Insufficient margins in clients' account. Our system will consider the margin requirements of all orders and positions of clients to achieve better risk management. Please delete those expired orders that hold your margins or increase the cash balance of your account.

‧ System problem on Exchange or broker side. Please contact your broker for further details and pending for the system resume.

‧ Password has expired. Our system also requires client to change their passwords regularly to ensure security. If password has expired, users just need to change to a new password before trading.

‧ Insufficient margins in clients' account. Our system will consider the margin requirements of all orders and positions of clients to achieve better risk management. Please delete those expired orders that hold your margins or increase the cash balance of your account.

‧ System problem on Exchange or broker side. Please contact your broker for further details and pending for the system resume.

2. How can users tackle the disconnection problem?

Please logout and login again. Go to "Statusà Connection Status" to check the connectivity of all links, and press "C" button to try reconnection..

If problem still exists, please contact your ISP to check the stability of your network first. You may also contact your broker afterwards to know the reason for disconnection.

3. What can users do if they have outstanding orders while disconnection occurs?

Users have to determine immediately whether to delete the existing orders in SP system. They can contact their brokers for confirmation of order status or deletion of orders.

4. What can users do if the windows in SPtrader disappear?

It is recommended that users have to go to "Desktopà Save desktop" to save their own desktop layout. Every time when login the program will load the last saved desktop layoutbackground.

If users find that part or all of the windows disappear, users can go to "DesktopàLoad desktop" to load back their saved desktop layout.

If users find that part or all of the windows disappear, users can go to "DesktopàLoad desktop" to load back their saved desktop layout.

5. Under what conditions will the limit orders or stop loss orders unable to be deleted?

Since the market price may fluctuate drastically, clients' orders may be traded immediately and cannot be deleted.

6. How long will the users' orders remain active?

The orders will remain active during the trading hours unless being inactivated/ deleted by users or the market close. If orders are not traded during the trading day, they will be considered expired after the market close.

7. Why users cannot change or delete orders on Hang Seng Index (HSI), Mini Hang Seng Index(MHI) and H-shares index futures(HHI) during the pre-opening session?

There are regulations by HKEX on order placing of HSI, MHI and HHI futures during the pre-opening session (8:45am-9:15am and 1:00pm-1:30pm).

‧ During the pre-opening periods of 8:45am-9:11am and 1:00pm-1:26pm, the exchange accepts any adding, changing or deleting of AO or AO limit orders.

‧ During the pre-opening periods of 9:11am-9:13am and 1:26pm-1:28pm, the exchange accepts placing of AO orders only. No modifications of orders are allowed.

‧ All actions are forbidden two minutes before the market open.

The following table displays the actions that can be done during the trading day."∨" indicates the actions that can be performed at a particular time period.

Remark: Orders on HSI/HHI/MHI options and MCH futures can be placed only during the market open session (9:15am-12:30am, 1:30pm- 4:15pm).

‧ During the pre-opening periods of 8:45am-9:11am and 1:00pm-1:26pm, the exchange accepts any adding, changing or deleting of AO or AO limit orders.

‧ During the pre-opening periods of 9:11am-9:13am and 1:26pm-1:28pm, the exchange accepts placing of AO orders only. No modifications of orders are allowed.

‧ All actions are forbidden two minutes before the market open.

The following table displays the actions that can be done during the trading day."∨" indicates the actions that can be performed at a particular time period.

| Buy/Sell | order | change order | delete order | |

| 08:45am - 09:11am | ∨ | ∨ | ∨ | ∨ |

| 09:11am - 09:13am | ∨ | |||

| 09:13am - 09:15am | ||||

| 09:15am - 12:00pm | Morning Market Open Sessionps:No AO orders are allowed | |||

| 01:00pm - 01:26pm | ∨ | ∨ | ∨ | ∨ |

| 01:26pm - 01:28pm | ∨ | |||

| 01:28pm - 01:30pm | ||||

| 01:30pm - 04:15pm | Afternoon Market Open Session ps:No AO orders are allowed | |||

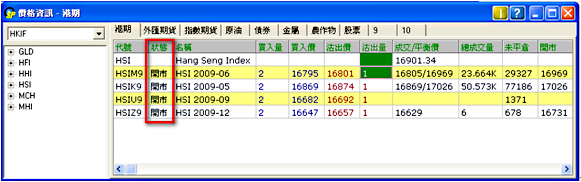

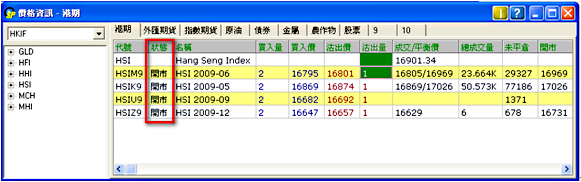

8. How can users identify the Exchange market status through our system?

User can find the market status"TSS" in "Market Price" window, which is updated according to the trading session defined by Exchange.

"TSS" column displays the market status, which indicates whether users can place orders or not during that session. Following illustrates the meaning of different market status:

Following is an overall view of market status changes in futures, options and stock system:

Remark: The above illustration applies to HK market only

"TSS" column displays the market status, which indicates whether users can place orders or not during that session. Following illustrates the meaning of different market status:

| Status | Session | Description |

| PRE | PRE-OPENING Session | Can place auction order (AO) & auction limit order. Allow alterations and deletions of orders. |

| POA | PRE-OPEN Allocation Session | Can place auction order(AO)only.No alterations or deletions of orders are allowed. |

| OPA | OPEN Allocation Session | Cannot add, change or delete orders |

| PRE-MKT | PRE-Market Activity Session | Allow deletions of orders only |

| OPEN | Market Opening Session | Can add, change or delete orders. Auction orders(AO) are forbidden. |

| PAUSE | Market Pause Session | Cannot add, change or delete orders |

| CLOSE | Market Close Session | Cannot add, change or delete orders |

| SUSPENDED | (Stock only) Suspension of security | Forbidden on trades of particular security |

Following is an overall view of market status changes in futures, options and stock system:

| 時段 | 狀態 | ||||

| Futures | Options | Stocks | Stock Options | Gold Futures | |

| 上午開市前時段 | PRE | PRE-MKT | PRE | PRE-MKT | OPEN |

| POA | POA | ||||

| OPA | OPA | ||||

| PAUSE | PAUSE | ||||

| 上午開市時段 | OPEN | ||||

| 中午休市時段 | PAUSE | ||||

| 下午開市前時段 | PRE | PRE-MKT | PRE-MKT | PRE-MKT | |

| POA | |||||

| OPA | |||||

| PAUSE | |||||

| 下午開市時段 | OPEN | ||||

| 收市時段 | CLOSE | ||||

Account Information

1. What is "Margin"?

In the futures market, investors need to deposit a particular amount of money (known as "margin") while transaction. The amount is defined by the exchange from the estimation of daily market risk.

During the day end there may be adjustments to investors' equity based on the market value of each traded futures contract they hold , which is known as "mark-to-market".

If the initial margin falls below the maintenance margin level after "mark-to-market", investors have to make deposit to reach the initial margin requirement.

During the day end there may be adjustments to investors' equity based on the market value of each traded futures contract they hold , which is known as "mark-to-market".

If the initial margin falls below the maintenance margin level after "mark-to-market", investors have to make deposit to reach the initial margin requirement.

2. What is "Initial Margin"?

This is the minimum margins required before opening a position. The initial margins for different products are standardized by different exchanges.

3. What is "Maintenance Margin"?

Default setting of maintenance margin is 80% of the initial margin (The exact amount is standardized by different exchanges).

Since the futures price may fluctuate drastically that causes the total equity of clients' account to drop below the maintenance margin level, what client have to do is to make deposit to reach the initial margin requirement.

Since the futures price may fluctuate drastically that causes the total equity of clients' account to drop below the maintenance margin level, what client have to do is to make deposit to reach the initial margin requirement.

4. What is "Margin Call"?

If the total equity of clients' accounts drops below the maintenance margin level, negative buying power will be shown in clients' accounts and the broker may call their margin.

Clients have to make deposit to reach the initial margin requirement or closing their positions before market close.

Clients have to make deposit to reach the initial margin requirement or closing their positions before market close.

5. If my account cannot achieve the maintenance margin requirement, will my broker liquidate my positions? Under what situation will forced liquidation occurs?

Different brokers implement differently regarding forced liquidation. Normally if clients' total equity cannot reach the maintenance margin level, brokers will reserve the right on forced liquidation for clients.